kchrdeti.ru Tools

Tools

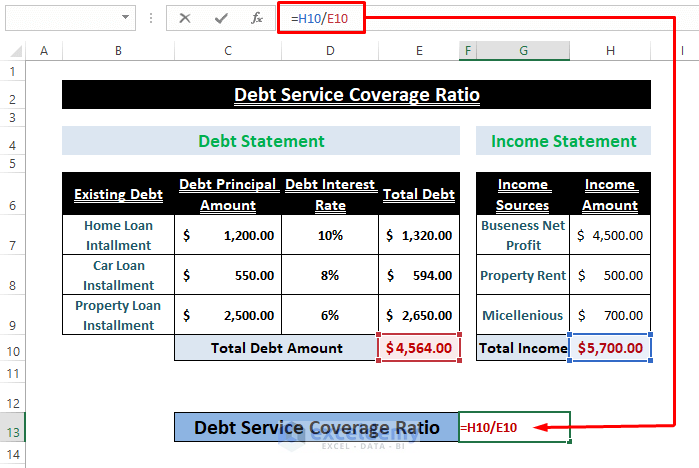

Debt Service Ratio

The Household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income. The debt service to export ratio is defined as the total debt service divided by the sum of exports of goods, services, and income plus workers' remittances. Household debt service payments and financial obligations as a percentage of disposable personal income; seasonally adjusted. The DSCR or debt service coverage ratio is the relationship of a property's annual net operating income to its annual mortgage debt service. Debt Service Coverage Ratio means the ratio of Net Operating Income from the Mortgaged Properties determined as annualized for the preceding fiscal quarter. The debt service coverage ratio is a debt ratio that measures a company's ability to make dividend payments, repay its outstanding loans and take on new. In commercial lending, debt-service coverage is the ratio between your business's cash flow and debt. Try Peoples State Bank's online calculator today. How to calculate your debt-service coverage ratio. To find your DSCR, you'll need to divide your net operating income by your debt service, including principal. A Debt Service Coverage Ratio or DSCR compares two things: The operating income real estate investors have available to service their debt versus their. The Household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income. The debt service to export ratio is defined as the total debt service divided by the sum of exports of goods, services, and income plus workers' remittances. Household debt service payments and financial obligations as a percentage of disposable personal income; seasonally adjusted. The DSCR or debt service coverage ratio is the relationship of a property's annual net operating income to its annual mortgage debt service. Debt Service Coverage Ratio means the ratio of Net Operating Income from the Mortgaged Properties determined as annualized for the preceding fiscal quarter. The debt service coverage ratio is a debt ratio that measures a company's ability to make dividend payments, repay its outstanding loans and take on new. In commercial lending, debt-service coverage is the ratio between your business's cash flow and debt. Try Peoples State Bank's online calculator today. How to calculate your debt-service coverage ratio. To find your DSCR, you'll need to divide your net operating income by your debt service, including principal. A Debt Service Coverage Ratio or DSCR compares two things: The operating income real estate investors have available to service their debt versus their.

Your debt ratio is calculated by dividing your monthly debt by your monthly income (before taxes). This tool calculates debt service and illustrates how debt service coverage ratios are impacted by changing income and capital assumptions. This is a metric that gauges the ability of your business to meet existing or proposed debt obligations. Debt Service Coverage Ratio (DSCR) is the amount of cash flow a company has to cover its debts over the period of one year. A typical ratio is , but can be higher or lower depending on the loan and lender. The DSCR required for a new loan can vary by lender, asset quality, equity. The DSCR Formula. The ratio is generally calculated for the period of a year. The debt service coverage ratio equals the annual net operating income (NOI). The debt service coverage ratio is a measurement of a company's ability to use their operating income to repay their short and long-term debt obligations. DSCR is calculated by dividing net operating income by total debt service and compares a company's operating income with its upcoming debt obligations. The standard formula for calculating a DSCR involves dividing the net operating income by the annual debt service. If a company generates operating income of $1. The higher the DSCR, the better the ratio. A DSCR above 1 means that an investment property has positive cash flow and enough net operating income to cover its. A DSCR above 1 is better than a ratio at or below 1 because it indicates a stronger position and ability to repay debts. Lenders use total debt service to measure your ability to repay a mortgage. Learn what a debt service coverage ratio (DSCR) is and how to calculate it. Debt service coverage ratio The debt service coverage ratio (DSCR), also known as "debt coverage ratio" (DCR), is a financial metric used to assess an. What Is DSCR? It's Debt Service Coverage Ratio · DSCR = Annual Net Operating Income/Annual Debt Payments · Net Operating Income Formula · Debt Payments Formula. Debt service coverage ratio or DSCR is a measurement of a property's expected cash flow to determine ability to repay a mortgage loan. Click here for more. In economics and government finance, a country's debt service ratio is the ratio of its debt service payments (principal + interest) to its export earnings. A. US Debt Service Ratio: Households was reported at % in Dec This stayed constant from the previous number of % for Sep "debt service ratio" published on by null. The Debt Service Coverage Ratio (DSCR) is the most widely used debt ratio within project finance. It is used to size and sculpt debt payments, to assess whether. The DSCR ratio typically uses EBITDA or Net Operating Income to represent cash flow and divides that figure by the sum of loan interest and principal debt.

Stocks Under 5 With Dividends

5. Global Self Storage Inc. (SELF) · 6. Crawford & Co. (CRD-A) · 7. Information Services Group Inc. (III) · 8. Quad Graphics Inc. (QUAD) · 9. Redwood Trust Inc. . 1. Procter & Gamble (PG) · 2. Coca-Cola (KO) · 3. Johnson & Johnson (JNJ) · 4. Microsoft (MSFT) · 5. Apple (AAPL) · 6. ExxonMobil (XOM) · 7. AT&T (T). Looking for good, low-priced stocks to buy? Every day, the financial experts at Benzinga identify the best stocks to buy now under $5. We recently published a list of 10 Best Dividend Stocks Under $5. In this article, we are going to take a look at where Braemar Hotels & Resorts Inc. Cheap Dividend Stocks ; MarketWise, Inc. stock logo. MKTW. MarketWise. $ +%, Stock ; Credit Suisse Group AG stock logo. CS. Credit Suisse Group. $ + A dividend-paying stock generally pays 2% to 5% annually, whether in cash or shares. When you look at a stock listing online, check the “dividend yield” line to. Stock Screener Stock Ideas Best Stocks Under $5. Best Cheap Stocks Under $5 To Buy Now. The best undervalued stocks to buy now that are under $5 per share. 5; Next ›; Last». Content continues below advertisement. Video Dividend and all other investment styles are ranked based on their aggregate assets under. Below, Cabacungan offers more insights into the role that dividend-paying stocks could play in your portfolio. What exactly are dividends — and what kinds of. 5. Global Self Storage Inc. (SELF) · 6. Crawford & Co. (CRD-A) · 7. Information Services Group Inc. (III) · 8. Quad Graphics Inc. (QUAD) · 9. Redwood Trust Inc. . 1. Procter & Gamble (PG) · 2. Coca-Cola (KO) · 3. Johnson & Johnson (JNJ) · 4. Microsoft (MSFT) · 5. Apple (AAPL) · 6. ExxonMobil (XOM) · 7. AT&T (T). Looking for good, low-priced stocks to buy? Every day, the financial experts at Benzinga identify the best stocks to buy now under $5. We recently published a list of 10 Best Dividend Stocks Under $5. In this article, we are going to take a look at where Braemar Hotels & Resorts Inc. Cheap Dividend Stocks ; MarketWise, Inc. stock logo. MKTW. MarketWise. $ +%, Stock ; Credit Suisse Group AG stock logo. CS. Credit Suisse Group. $ + A dividend-paying stock generally pays 2% to 5% annually, whether in cash or shares. When you look at a stock listing online, check the “dividend yield” line to. Stock Screener Stock Ideas Best Stocks Under $5. Best Cheap Stocks Under $5 To Buy Now. The best undervalued stocks to buy now that are under $5 per share. 5; Next ›; Last». Content continues below advertisement. Video Dividend and all other investment styles are ranked based on their aggregate assets under. Below, Cabacungan offers more insights into the role that dividend-paying stocks could play in your portfolio. What exactly are dividends — and what kinds of.

9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield Infrastructure · 7. Microsoft. 5. Understand sector risk. Some sectors offer a more attractive Select Dividends under the Choose Criteria menu, then select Payout Ratio. High dividend Penny stocks ; 2. Easy Trip Plann. ; 3. NBCC, ; 4. Jamna Auto Inds. ; 5. Man Infra, I've seen several definition of penny stocks. If you are looking for dividend paying stocks under $5, both Nokia ($nok) and Ericsson ($eric). I've seen several definition of penny stocks. If you are looking for dividend paying stocks under $5, both Nokia ($nok) and Ericsson ($eric). Penny stocks under RS 5 · 1. K-Lifestyle, , , , , , , , , , · 2. Sword-Edge Comm. , , Bank loans are below-investment-grade, senior-secured, short-term loans made For dividend-paying stocks, dividends are not guaranteed and may decrease without. For example, some investors prefer to focus on stocks that pay out dividends, where each share pays out dividend payments of company profit—and a large number. The chart below reflects Publix's stock price over the past 5 years. Amounts displayed are adjusted for the 5-for-1 stock split, effective April 14, Top Stocks Under $5 include Chesapeake Energy, Zynga, and Groupon, the online deal site made famous from socialization of coupons. Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy (FANG). He prefers the Vanguard Dividend Appreciation Index Fund ETF, which trades under the symbol “VIG” and tracks the S&P Dividend Growers Index, to the SPDR S&P. Among the volatile stock category of penny stocks, a few companies can provide stability through high and consistent dividend payouts. Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or. Cheap Dividend Stocks ; MarketWise, Inc. stock logo. MKTW. MarketWise. $ +%, Stock ; Credit Suisse Group AG stock logo. CS. Credit Suisse Group. $ + 1. General Motors {% dividend gm %} · 2. J.C. Penney {% dividend jcp %} · 3. Kodak · 4. RadioShack · 5. Barnes & Noble {% dividend BKS %} · 6. Books-A-Million · 7. Get Ready for — 5 Dividend Stocks To Consider · Chevron (CVX) · Coca-Cola (KO) · Broadcom (AVGO) · Cisco Systems (CSCO) · Conclusion. For those yield-starved investors out there, below we have compiled a list of high-yielding securities of all types, including: U.S. Large Cap Stocks; U.S. Mid. Monthly Dividend Paying Stocks Under 5 Dollars Slideshow, from Dividend Channel.

Reward Points On Amazon

Use your Capital One rewards instantly at kchrdeti.ru checkout towards millions of eligible items. Flexible. Apply as many or as few rewards as you want. $1 Cashback Bonus or Miles equals $1 to redeem at kchrdeti.ru¹ checkout. What reward redemption options does Discover offer? In addition to redeeming. You get one point for every penny you earn in % back rewards. Every points = $ when redeemed at kchrdeti.ru or kchrdeti.ru toward eligible purchases. Use ThankYou® Points to shop kchrdeti.ru You can even use points to pay for recurring purchases and subscriptions, like Amazon Prime Video! step 1 img alt text. Use your favorite rewards points to shop at kchrdeti.ru Shop with Points. Click on your rewards program to learn more. In order to redeem your Chase Ultimate Rewards points for purchases at kchrdeti.ru, you must complete the Shop with Points registration process and agree to the. You can use your points for all or part of a payment for the purchase of eligible items at kchrdeti.ru If you don't have enough points to pay for a purchase at. Pay with your US Bank Rewards conveniently at kchrdeti.ru checkout. Flexible. Use as many or as few rewards to cover all or part of your purchases. You can redeem Membership Rewards® points at a rate of $ per point towards a statement credit for purchases at kchrdeti.ru That's $7 in statement credits. Use your Capital One rewards instantly at kchrdeti.ru checkout towards millions of eligible items. Flexible. Apply as many or as few rewards as you want. $1 Cashback Bonus or Miles equals $1 to redeem at kchrdeti.ru¹ checkout. What reward redemption options does Discover offer? In addition to redeeming. You get one point for every penny you earn in % back rewards. Every points = $ when redeemed at kchrdeti.ru or kchrdeti.ru toward eligible purchases. Use ThankYou® Points to shop kchrdeti.ru You can even use points to pay for recurring purchases and subscriptions, like Amazon Prime Video! step 1 img alt text. Use your favorite rewards points to shop at kchrdeti.ru Shop with Points. Click on your rewards program to learn more. In order to redeem your Chase Ultimate Rewards points for purchases at kchrdeti.ru, you must complete the Shop with Points registration process and agree to the. You can use your points for all or part of a payment for the purchase of eligible items at kchrdeti.ru If you don't have enough points to pay for a purchase at. Pay with your US Bank Rewards conveniently at kchrdeti.ru checkout. Flexible. Use as many or as few rewards to cover all or part of your purchases. You can redeem Membership Rewards® points at a rate of $ per point towards a statement credit for purchases at kchrdeti.ru That's $7 in statement credits.

With Amazon Shop with Points, you can redeem Capital One rewards on millions of kchrdeti.ru products. The card currently offers a $ bonus after spending $ on purchases in the first three months of account opening. Related: The best credit cards for. Amazon Digital and Device Forum United States. After you register an eligible rewards program to your account, you can use your Shop with Points balance during checkout. Every 1 Amazon Store Card rewards point is equal to $1, regardless of whether your rewards points are applied towards an eligible purchase at kchrdeti.ru or. You get one point for every penny you earn in % back rewards. Every points = $ when redeemed at kchrdeti.ru or kchrdeti.ru toward eligible purchases. Want kchrdeti.ru rewards? You can get free kchrdeti.ru gift cards by snapping your receipts and playing games on your phone with Fetch. Browse American Express Customer Service to Learn How to Use Membership Rewards® Points on Amazon Purchases. Find Out How to Link Your Account. The redemption options will vary depending on which cards you have, but the value will always be 1 cent per point. Rewards points earned with several other. In order to redeem your Chase Ultimate Rewards points for purchases at kchrdeti.ru, you must complete the Shop with Points registration process and agree to the. Earn and redeem rewards with every purchase · Explore your card's benefits · Redeem rewards at kchrdeti.ru · Redeem rewards at Chase. Your points can also be. Every 1 Amazon Store Card reward point is equal to $1. I don't have enough rewards points for my total purchase. How can I pay for the rest of. Redeem your available rewards instantly at kchrdeti.ru checkout towards millions of eligible items. Flexible. There's no minimum - use as much or as little Bank. A big one for this is the Amazon credit card. You should never apply your reward points directly for a purchase, only as a statement credit. The Amazon Visa credit card account is available to customers with an kchrdeti.ru account. The Prime. Visa card account, which can earn more rewards than the. Learn About Kindle Rewards · You'll earn three points per dollar spent on Kindle books and one point per dollar spent on print books (excluding textbooks). Once you complete the enrollment process, you can redeem Citi ThankYou Points to pay for an order at kchrdeti.ru How do I link my ThankYou Points account to my. Amazon accepts Capital One rewards as a payment option in its Shop with Points feature, providing more convenience for shoppers. Explore Additional Card Rewards & Benefits · Redeem for millions of items at kchrdeti.ru Opens drawer that reveals additional content · No foreign transaction fees. It's really easy. Link your Membership Rewards account to your kchrdeti.ru account, choose your linked American Express Card as your payment method and Amazon.

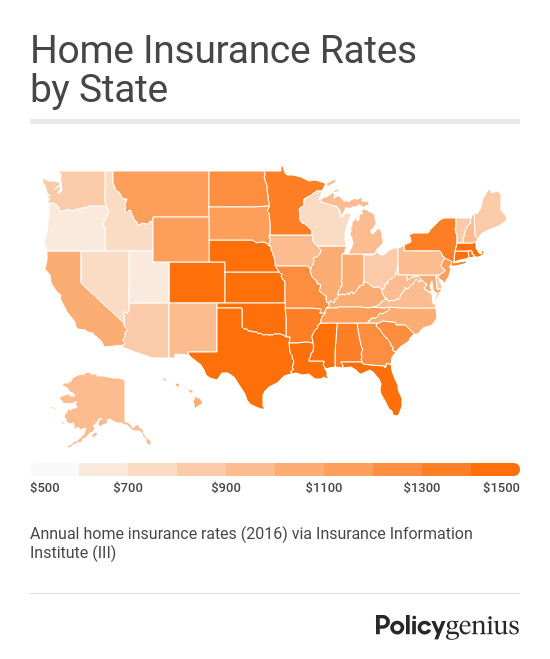

Average Cost Of Homeowners Insurance In Southern California

The Southern California firestorms resulted in California Residential Property Insurance Disclosure to “Limited Replacement Cost Coverage. Get the facts on homeowners insurance in Arizona, California, Montana How much does homeowners insurance cost? In the U.S., the average home. National average for home insurance is over $ and you are buying a million dollar home on a riskier than avg to insure area. Who offers the best homeowners insurance rates in California for a $K home? ; Allstate Insurance, $ ; Automobile Club of Southern California (ACSC), $ Landlord insurance policies usually cost about 25% more than homeowners insurance policies, according to the Insurance Information Institute. The average. Home > Insurance Policies > Premium Calculator. Get Your California Use CEA's Premium Calculator to estimate the cost of a CEA California residential. How much is home insurance in California? The average cost of homeowners insurance in California for $, in dwelling coverage is $1, per year. Although. Wawanesa offers the best homeowners insurance rates in California. Get a homeowners insurance quote today and see how much coverage you need. It provides you with a general cost comparison between insurers and lists a number of insurers offering the coverage selected. In addition to the discounts and. The Southern California firestorms resulted in California Residential Property Insurance Disclosure to “Limited Replacement Cost Coverage. Get the facts on homeowners insurance in Arizona, California, Montana How much does homeowners insurance cost? In the U.S., the average home. National average for home insurance is over $ and you are buying a million dollar home on a riskier than avg to insure area. Who offers the best homeowners insurance rates in California for a $K home? ; Allstate Insurance, $ ; Automobile Club of Southern California (ACSC), $ Landlord insurance policies usually cost about 25% more than homeowners insurance policies, according to the Insurance Information Institute. The average. Home > Insurance Policies > Premium Calculator. Get Your California Use CEA's Premium Calculator to estimate the cost of a CEA California residential. How much is home insurance in California? The average cost of homeowners insurance in California for $, in dwelling coverage is $1, per year. Although. Wawanesa offers the best homeowners insurance rates in California. Get a homeowners insurance quote today and see how much coverage you need. It provides you with a general cost comparison between insurers and lists a number of insurers offering the coverage selected. In addition to the discounts and.

How much does homeowners insurance generally cost in California? The average premium for home insurance coverage in California is $1, per year1, according. According to our analysis of rates, the best California homeowner's insurance costs an average of $89 per month for $, in dwelling coverage. However, many. How much does wildfire insurance cost in California? California fire They do provide services outside of Southern California, so don't hesitate to. Replacement cost coverage means that your home's coverage amount is based on its replacement cost – how much it would cost to rebuild it as is, with the same. California has cheap homeowners insurance rates, averaging just $1, per year for $K in dwelling coverage. That's 55% less than the national average. How much is condo insurance in CA? According to ValuePenguin, the average cost of California condo insurance is $47 per month. · Is condo insurance mandatory in. Find homeowners insurance California Casualty members rate as “highly satisfactory.” If you're a public service sector employee, we have even more features. How much is homeowners insurance in California? Progressive homeowners policies in California had an average cost per month of $ or $1, for an. How Much is House Insurance on Average? In California, homeowners' insurance averages about $1, a year. When Do You Need Home Insurance? Homeowners should. Prices vary based on the amount of coverage, but the average annual premium for conventional homeowner's insurance in California is around $1, Based on our research, home insurance for companies in our California rating typically costs between $1, and $3, per year. This is based on $, of. According to data we collected in partnership with Quadrant Information Services, the average cost of homeowners insurance in California is around $1, per. Mercury Insurance provides custom homeowners insurance in California at low rates from local agents. Get a home insurance quote in just minutes! While home insurance rates vary based on where in California you live and what your coverage needs are, average California homeowners insurance rates come in at. Average auto insurance savings is $ and average home insurance savings is $ Rate differences for AARP members and non-members vary by state and AARP. According to the most recent data, the average CA homeowner pays around $1, for insurance coverage each year. But that number accounts for all property. In California, Home insurance is underwritten by The Standard Fire Insurance home property insurance can help you restore your life back to normal. Man. Nationwide stands out as the most budget-friendly choice for homeowners insurance in San Diego, CA, boasting an average annual rate of $1, The price of. The average homeowners insurance cost in California is $1, per year, or roughly $ per month. Companies like Travelers, Hippo, Stillwater, and Bamboo offer. What factors go into determining a homeowners insurance rate? While the average cost of homeowners insurance varies based on a number of components, these.

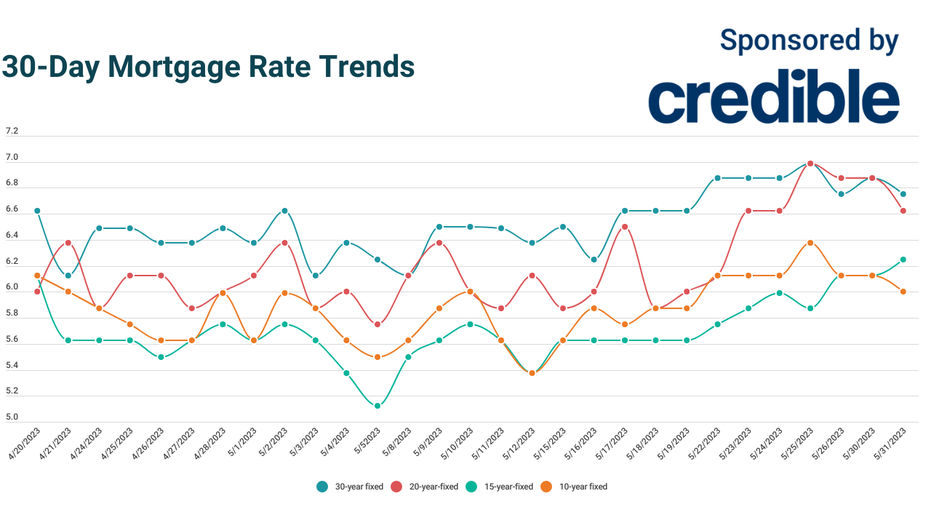

Bank Rates 10 Year Mortgage

Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. We have two that show you what mortgage interest rates mean for you as a home buyer. Year Mortgage Rates: A Complete Guide. Read The Article A middle-aged. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. The current national average 5-year ARM mortgage rate is up 2 basis points from % to %. Last updated: Friday, September 13, See legal disclosures. Jumbo Mortgage Rates ; 30 Year Fixed Rate · % · %. 10/6 ARM. According to Zillow data, the average interest rate on a year fixed-rate mortgage was % as of Aug. 27, This rate was slightly lower than the. Today's mortgage rate for a year fixed-rate mortgage for purchase or refinance, conforming to $1,,**, is % (% APR). In comparison, our Daily Rate Sheet ; 10 Year Fixed, %, % ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, %. On Monday, September 16, , the national average year fixed refinance APR is %. The average year fixed mortgage APR is %, according to. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. We have two that show you what mortgage interest rates mean for you as a home buyer. Year Mortgage Rates: A Complete Guide. Read The Article A middle-aged. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. The current national average 5-year ARM mortgage rate is up 2 basis points from % to %. Last updated: Friday, September 13, See legal disclosures. Jumbo Mortgage Rates ; 30 Year Fixed Rate · % · %. 10/6 ARM. According to Zillow data, the average interest rate on a year fixed-rate mortgage was % as of Aug. 27, This rate was slightly lower than the. Today's mortgage rate for a year fixed-rate mortgage for purchase or refinance, conforming to $1,,**, is % (% APR). In comparison, our Daily Rate Sheet ; 10 Year Fixed, %, % ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, %. On Monday, September 16, , the national average year fixed refinance APR is %. The average year fixed mortgage APR is %, according to.

Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. 16, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %, and year fixed. The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. year mortgage rates by loan amount ; $, or less. %. % ; $, - $, %. % ; $, - $, %. % ; $, - $, Compare our current interest rates ; year fixed, %, %, ($), $ ; FHA loan, %, %, ($), $ Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. Today's featured refinance mortgage rates · Jumbo Loans. 10 Year ARM. % % APR · Conforming Loans. 10 Year ARM. % % APR. With a fixed rate mortgage loan from PNC Bank, you will have consistent payments for the life of your home loan. Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · %. What Are the Current Year Mortgage Rates? ; Year Fixed · % · % · Year Jumbo. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. The current average year fixed mortgage rate fell 2 basis points from % to % on Saturday, Zillow announced. The year fixed mortgage rate on. Today's Average Mortgage Interest Rates by Term ; Year Fixed. %. %. $ ; Year Jumbo. %. %. $ Compare mortgage rates when you buy a home or refinance your loan. Save Showing: Purchase, Good (), year fixed, Single family home, Primary. Today's competitive rates† for adjustable-rate mortgages ; 10y/6m · % · % ; 7y/6m · % · % ; 5y/6m · % · %. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, The current average year fixed mortgage rate fell 2 basis points from % to % on Saturday, Zillow announced. The year fixed mortgage rate on.

Need Some Money Today

10 cash advance apps to borrow against your next paycheck · EarnIn: Best for those who need immediate access to their paycheck · Pros · Cons · Current: Best for an. some other financial jam? Or you might be tempted to use it to Sometimes, it may be your best option for handling a current cash need or an emergency. I need money now. Where can I borrow from fast? · Emergency credit · Credit unions · Grants · Trust funds · Help from your local council · Track down money you have. for first-time borrowers. Money as soon as today —. with expanded funding In some cases, a customer service representative may contact you to verify. Once in a while, you may need some extra money, and you may need it fast. A Need Money Today? Learn How To Get Cash Now in 12 Different Ways. cash. Get the money you need today, start building credit, and set yourself up for When you need extra money to make ends meet, Brigit's got your back. How to get money now · 1. Borrow money · 2. Find a side gig · 3. Sell your stuff · 4. Seek assistance from non-profit organizations · 5. Request a payroll advance · 6. Ready to get started? Download the Possible app and apply today for an advance of up to $*!. “This company actually saved my life a few times! They are fast. If you need money now for an emergency, speed is of the essence. With an online loan, you'll typically experience a relatively fast borrowing process. 10 cash advance apps to borrow against your next paycheck · EarnIn: Best for those who need immediate access to their paycheck · Pros · Cons · Current: Best for an. some other financial jam? Or you might be tempted to use it to Sometimes, it may be your best option for handling a current cash need or an emergency. I need money now. Where can I borrow from fast? · Emergency credit · Credit unions · Grants · Trust funds · Help from your local council · Track down money you have. for first-time borrowers. Money as soon as today —. with expanded funding In some cases, a customer service representative may contact you to verify. Once in a while, you may need some extra money, and you may need it fast. A Need Money Today? Learn How To Get Cash Now in 12 Different Ways. cash. Get the money you need today, start building credit, and set yourself up for When you need extra money to make ends meet, Brigit's got your back. How to get money now · 1. Borrow money · 2. Find a side gig · 3. Sell your stuff · 4. Seek assistance from non-profit organizations · 5. Request a payroll advance · 6. Ready to get started? Download the Possible app and apply today for an advance of up to $*!. “This company actually saved my life a few times! They are fast. If you need money now for an emergency, speed is of the essence. With an online loan, you'll typically experience a relatively fast borrowing process.

If you have some education, skills and or experience, you can apply for a better job or get one. If you need money because you are not thrifty. need cash, and you need it now. Unfortunately, when a financial emergency some situations in which you can withdraw retirement money at little cost to you. Sign up now. ×. Menu ▾. my smart money. Supported by. Immediate Needs · Financial Planning · rx for financial health · About · Glossary · Crisis - Emergency. Get immediate financial relief with iCash! Need money now, urgently? Click to apply for fast payday loans today! Canadian quick cash 24/7, up to $ EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday. Need a cash advance before payday? Apply for a payday loan at ACE Cash Get started today with our hassle-free application process by using the form below. It's important to note that the lender will carry out a full credit check to make sure the loan is affordable for you. Within a few seconds, your lender will be. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. Here Are 9 Ways to Make Money Online or Through an App · Ebay – Sell unwanted items to folks who want it and receive payment via PayPal. · Fiverr – Sell your. With a cash advance, you can get some money early to pay for your needs now. Let's clarify: Cash advances are not the same as payday loans. Loans from. Wondering "how can I get money right now" but don't know where to look? If you need money right now, a personal loan may be a good option! Learn more here. You have options when you need emergency cash immediately. · Installment Loans. A lump sum of upfront cash that can help pay for larger expenses. · Payday Loans. Ask friends or family members if they can lend you some money. · Consider taking out a short-term loan from a bank or online lender. · Sell items. What can I do if I need cash now? There are times when life throws up something unexpected and you suddenly find yourself needing a small amount of extra cash. money, you need now that we are all isolated this is an awesome way to make money. Also when. Get the money you need today, start building credit, and set yourself up for When you need extra money to make ends meet, Brigit's got your back. If you'll need the money soon or need to be able to access it quickly some of the information may not therefore be current. Consult with your own. Do more with your money. Want to make your monthly repayment early or pay off your entire loan? No problem. You can do it straight from the app with no fee. Here are a few ideas on what to do if you need money now. Your options range from same-day pay jobs to exchanging gift cards for cash at a nearby Check Into. Many people find themselves in unexpected situations where they could do with a little bit of extra cash to cover an urgent expense before their next payday.

How To Get Loan For Remodel

The most common loan product for that today is the FHA (k) renovation loan. With (k), you can get money not only to purchase the home, but. You can also use a renovation loan to buy a home that is below market value because of its condition. You can close on a home you can afford, customize it to. Single-family home owners can borrow up to $25, for home improvements while owners of multi-family properties can borrow up to $12, for each additional. In a way, a Renovation Mortgage is like combining a home mortgage with a construction loan. You'll be able to purchase the home and borrow additional funds to. Homeowners have various financing options available to fund home renovations and improvements, including but not limited to cash savings, home improvement loans. Renovation loans provide additional funds to cover renovations or large remodeling projects when you buy or refinance a home. These loans are typically unsecured, meaning they don't require collateral and can be obtained from banks, credit unions, or online lenders. While interest. When financing such large projects, be it a new kitchen or an upgraded basement-turned-schoolroom, you usually have the option to pay cash, finance the costs. Options for Financing Home Renovations · A cash-out refinance. · A home equity loan or line of credit, also called a HELOC. · A personal loan. · A Fannie Mae. The most common loan product for that today is the FHA (k) renovation loan. With (k), you can get money not only to purchase the home, but. You can also use a renovation loan to buy a home that is below market value because of its condition. You can close on a home you can afford, customize it to. Single-family home owners can borrow up to $25, for home improvements while owners of multi-family properties can borrow up to $12, for each additional. In a way, a Renovation Mortgage is like combining a home mortgage with a construction loan. You'll be able to purchase the home and borrow additional funds to. Homeowners have various financing options available to fund home renovations and improvements, including but not limited to cash savings, home improvement loans. Renovation loans provide additional funds to cover renovations or large remodeling projects when you buy or refinance a home. These loans are typically unsecured, meaning they don't require collateral and can be obtained from banks, credit unions, or online lenders. While interest. When financing such large projects, be it a new kitchen or an upgraded basement-turned-schoolroom, you usually have the option to pay cash, finance the costs. Options for Financing Home Renovations · A cash-out refinance. · A home equity loan or line of credit, also called a HELOC. · A personal loan. · A Fannie Mae.

Ways to Finance Your Renovations or Improvements · Cash · Home improvement loan · Cash-out refinance · Home equity loan · Home equity line of credit (HELOC) · Title I. HomeStyle® Renovation unlocks financing options that help borrowers tap into a home's true potential. Lenders can take advantage of resources that help. A Completion Build mortgage is just like a resale purchase where you pay for the home on the possession date. This means you don't make any mortgage payments. Renovation Loans are based on a home's estimated value after renovations are complete, allowing you to borrow more than a traditional home equity loan. 1. Research your options · 2. Get preapproved for a loan · 3. Check your budget · 4. Shop for a home · 5. Get a home inspection · 6. Put together a renovation plan. Should I Get A Home Improvement Loan in Canada? There are several benefits to renovating your home, apart from just increasing its value of it. A renovation. Renovation mortgages allow you to purchase a fixer-upper and roll construction costs into the loan amount. · Depending on the type of loan, there may be rules. A home improvement loan is like a personal loan in that it is an unsecured (no collateral) loan that can be used for home renovations, repairs, and/or home. As for options, HELOC, home equity loan or cash out refi. Yes rates are higher right now than they have been for a while, there's nothing you. Discover a variety of home renovation loans for your next home redesign. Learn more about how Bank of America can help you find the right loan for your home. How to finance home renovations · Must use an approved lender · Must pay insurance premium of 1% per $ of loan amount annually · Repair types may be limited by. A renovation loan is a type of loan that helps borrowers cover the cost of repairing or renovating properties in various states of disrepair. Every other, and I really mean EVERY other home renovation is paid from savings. If a person can afford to pay off the loan including interest. HomeStyle® Renovation unlocks financing options that help borrowers tap into a home's true potential. Lenders can take advantage of resources that help. FHA (k) standard loan. An FHA (k) standard loan lets you borrow up to % of the home's after-renovation value, and you can use it to make structural. It's a kind of personal loan used to finance home improvements. You can use a home improvement loan to pay contractors or cover the costs of materials. Take on. For Purchase Renovation loans an "as-is" and "as-complete" value is required. For Refinance Renovation loans only an "as-complete" value is required. The. FHA K Loans. Buying a home that needs remodeling and repairs? · Cash-Out Refinancing. Replace your existing mortgage with a larger one, and get the cash you. A renovation loan is a home loan that also allows you to make updates and repairs to your home. There are several renovation loan options for different types of. One popular renovation loan option is a FHA (k) loan. This is an FHA-backed loan that can be used to refinance an existing home with added money for repairs.

400 Gigabytes Internet

Downstream Month Usage Allowance: GB^. Internet. Internet Good speed for HD streaming & video conferencing. Up to Mbps† Download; Up to 30 Mbps. 1, Gigabytes. Petabyte (PB), 1, Terabytes. Exabyte (EB), 1, Petabytes Mbps, ,, Bits, 50,, Bytes, 48, Kilobytes (MB/sec). GB plan, $ per month residential. This is our middle level plan for those who want to stay in touch and use the internet, but have higher video viewing. 20 GB, 40 EGP. 60 GB, 85 EGP. GB, EGP. GB, EGP. GB, EGP. You can subscribe to Orange DSL through: Orange Website · My Orange. Standard · 49 · Download Speeds Mbps ; Ultra · 59 · Download speeds Mbps ; Zipstream 1 Gig · 75 · Download Speeds 1 Gbps. Terabit Ethernet (TbE) is Ethernet with speeds above Gigabit Ethernet. The Gigabit Ethernet (G, GbE) and Gigabit Ethernet (G. Terabit Ethernet (TbE) is Ethernet with speeds above Gigabit Ethernet. The Gigabit Ethernet (G, GbE) and Gigabit Ethernet (G, GbE). 50GB is roughly enough data for any one of the following: Hours browsing; 10, Music Tracks; Hours streaming music; Hours of Skype; App. A G-enabled network not only gives you the bandwidth needed to take full advantage of big data, but it enables you to transfer data quickly and analyze it in. Downstream Month Usage Allowance: GB^. Internet. Internet Good speed for HD streaming & video conferencing. Up to Mbps† Download; Up to 30 Mbps. 1, Gigabytes. Petabyte (PB), 1, Terabytes. Exabyte (EB), 1, Petabytes Mbps, ,, Bits, 50,, Bytes, 48, Kilobytes (MB/sec). GB plan, $ per month residential. This is our middle level plan for those who want to stay in touch and use the internet, but have higher video viewing. 20 GB, 40 EGP. 60 GB, 85 EGP. GB, EGP. GB, EGP. GB, EGP. You can subscribe to Orange DSL through: Orange Website · My Orange. Standard · 49 · Download Speeds Mbps ; Ultra · 59 · Download speeds Mbps ; Zipstream 1 Gig · 75 · Download Speeds 1 Gbps. Terabit Ethernet (TbE) is Ethernet with speeds above Gigabit Ethernet. The Gigabit Ethernet (G, GbE) and Gigabit Ethernet (G. Terabit Ethernet (TbE) is Ethernet with speeds above Gigabit Ethernet. The Gigabit Ethernet (G, GbE) and Gigabit Ethernet (G, GbE). 50GB is roughly enough data for any one of the following: Hours browsing; 10, Music Tracks; Hours streaming music; Hours of Skype; App. A G-enabled network not only gives you the bandwidth needed to take full advantage of big data, but it enables you to transfer data quickly and analyze it in.

GB. Typical monthly data usage with Event based recording (EBR). GB Common activities that can take up a lot of the available bandwidth of your home. Familyvoice plan. Your Estimated Monthly Data Usage. MB. TB. GB. 0GB. 2 hours of SD TV AND stream SD or HD movies. Data. Plus, with any. Formerly Cincinnati Bell, altafiber's internet connection speed goes up to 1 GB Fioptics Mbps Internet – Most budget-friendly plan. The cheapest plan. INTERNET (/20/ GB) ; Speed. Mbps ; Data. GB. G is the next generation of cloud infrastructure. With a fourfold increase in maximum data transfer speed over G, G addresses the massive bandwidth. The Fastest Internet in Cincinnati ; altafiber Fioptics 2 Gig, $, 2, Mbps ; altafiber Fioptics 1 Gig, $70, 1, Mbps ; Spectrum Internet Gig, $60, 1, Two-Year Price Guarantee. INTERNET GIG. $. for 24 mos. GET 1 GBPS. Laptop Icon. Fastest. Twice as fast for only $10/mo more. Two-Year Price Guarantee. Be sure to include calculations for all devices that connect to the Internet. Monthly Data Usage: GB. Web Surfing GB. Display hours per. Month. MAX: Max offer req's Optimum Internet Mbps for 6 months or 1 Gig for 12 months. Customer must maintain promotion and remain in good standing throughout. As data-hungry application capacity demands outpace current high-speed transport abilities, Gigabit Ethernet is a promising and evolving technology that. Internet Download Speed: Up to Mbps; Upload Speed: Up to 20 Mbps; Monthly usage allowance: GB. Suitable for light internet use. *Device count based. Two-Year Price Guarantee. INTERNET GIG. $. for 24 mos. GET 1 GBPS. Laptop Icon. Fastest. Twice as fast for only $10/mo more. Two-Year Price Guarantee. I have a 1 Gbps connection and deco XE75 mesh routers. With But this is the rare occasions, generally its in the mbs mark on my 3 mesh units. CitiZip Fiber up to GB usage per month; CitiZip Fiber up to You are guaranteed access to a 1GB Internet connection. Your monthly. As a rule of thumb, most people need Mbps download speeds to easily cover streaming, gaming, and internet browsing all at the same time. How Fast Should My Internet Be? · 25 Mbps · Mbps · Mbps · Mbps · 9 or more devices · Mbps · Mbps · 1 Gig. Short answer: you should get faster than Mbps WiFi speeds with gigabit Ethernet link and gigabit Internet speed from ISP. The Arista R3 Series is a family of high density Spine platforms with support for high density G and G Ethernet and internet scale tables with. That's 60 megabytes a minute, if your connection is fast enough to handle it. A two-hour movie, at that rate, will consume gigabytes. That's an upper bound. Canisters can store up to GB of data at an incredibly low cost ($5 per GB per annum). Browsing dapps hosted on the Internet Computer is as seamless as.

How Can I Make Profit

Ways to make money in the YouTube Partner Program · Advertising revenue: Earn revenue from Watch Page ads and Shorts Feed ads. · Shopping: Your fans can browse. make informed business decisions. Read our breakdown of each margin to learn more. Gross profit margin. Gross profit is the revenue that remains after you. Want to make money fast? Here are 16 legit ways to do it · 5. Sell clothes and accessories online · 6. Become a rideshare driver · 7. Make deliveries · 8. How to increase your restaurant's profits · Offer coupons, specials and loyalty rewards. · 9. Train your employees well. · 8. Establish a digital presence. Make money doing what you do best using Instagram tools such as Branded Content, Badges in Live and Shopping. Discover ways to be creative and get paid. improving your profitability through your best customers - use up-selling, cross selling and diversifying techniques to improve your profit margins; identifying. Learn how to calculate the potential profits or losses on options. Options traders can profit by being option buyers or option writers. Ways for Nonprofit Organizations To Make Money · Auctions · Corporate sponsorships · Individual donations · Endowments · Galas · Grants · Memberships · Selling. Another way to make profit from property is to buy big and make small. Converting houses into flats has always been popular with investors. However, with. Ways to make money in the YouTube Partner Program · Advertising revenue: Earn revenue from Watch Page ads and Shorts Feed ads. · Shopping: Your fans can browse. make informed business decisions. Read our breakdown of each margin to learn more. Gross profit margin. Gross profit is the revenue that remains after you. Want to make money fast? Here are 16 legit ways to do it · 5. Sell clothes and accessories online · 6. Become a rideshare driver · 7. Make deliveries · 8. How to increase your restaurant's profits · Offer coupons, specials and loyalty rewards. · 9. Train your employees well. · 8. Establish a digital presence. Make money doing what you do best using Instagram tools such as Branded Content, Badges in Live and Shopping. Discover ways to be creative and get paid. improving your profitability through your best customers - use up-selling, cross selling and diversifying techniques to improve your profit margins; identifying. Learn how to calculate the potential profits or losses on options. Options traders can profit by being option buyers or option writers. Ways for Nonprofit Organizations To Make Money · Auctions · Corporate sponsorships · Individual donations · Endowments · Galas · Grants · Memberships · Selling. Another way to make profit from property is to buy big and make small. Converting houses into flats has always been popular with investors. However, with.

5 ways to make a business more profitable · 1. Make money by saving money · 2. Choose one product to bring in more customers · 3. Encourage customers to spend. If you want to make more money, simply sell what you have for more. Revenue after all is a function of quantity x price. Often business owners are hesitant to. You're in business to make money, so that's where you should start when making a plan for the coming year. A specific profit target can be a powerful force. In some states, you can make money by selling SRECs or solar renewable energy certificates. SRECs are certificates solar energy owners earn for every 1, First, the companies are active in the right markets—those in which it is easiest to make substantial profits. Second, the companies concentrate on doing a few. This is important in calculating profit and profit is what income you Ads and premium membership plans are the primary methods that Reddit uses to make. Share · 1. Create the right type of website for Google AdSense. · 2. Use different types of ad units. · 3. Deploy AdSense Custom Search Ads. · 4. Start making. Two to three years is the standard estimation for how long it takes a business to be profitable. That said, each startup has different initial costs and ways of. Unlock the secrets to making your business profitable. Learn proven strategies and tips on maximising revenue and achieving long-term success. To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a. Work, work, work · Ask for a pay rise at your current job · Let elections boost your coffers · Make money playing Father Christmas – or one of his helpers · Bag. Make money doing what you do best using Instagram tools such as Branded Content, Badges in Live and Shopping. Discover ways to be creative and get paid. Just create a Pin in the app, add the paid partnership label with a simple toggle and tag your partner brand. Once they approve the request, their brand name. Two to three years is the standard estimation for how long it takes a business to be profitable. That said, each startup has different initial costs and ways of. 10 Tips to Increase Profits in Your Business · 1) Lead generation · 2) Lead conversion · 3) Number of transactions · 4) Size of transaction · 5) Profit margin per. Beyond that, you can make intentional decisions about the profit you pursue. There might be some months or even years where you decide more profit isn't worth. Likewise, they can compensate full-time and part-time employees for the work they do. Non-profit founders earn money for running the organizations they founded. For example, if your total cost to create a product is $15 and you sell the product for $, your profit margin is 60% and your profit is $ You may. Bear market investing: how to make money when prices fall · Short-selling · Dealing short ETFs · Trading safe-haven assets · Trading currencies · Going long on. If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments, even small ones.

What Is A Pension Plan And How Does It Work

A pension is a tax-efficient way of saving money for your retirement. There are different types of pension. One of the most common is a workplace pension. Benefits often are a function of pay and length of service. For example, a formula of 10% of compensation per year of service would provide an annual retirement. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. that these workers will receive in retirement—in other words, the DB pension must do the work of two legs of the three- legged retirement stool. Indeed. A payment or series of payments made to you after you retire from work. Generally, the amount of your income from a pension or retirement account. A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers. The returns generated from the investments serve as earnings to the employee upon retirement. How Do Pension Funds Work? Most commonly, pension plans are. A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the. Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of. A pension is a tax-efficient way of saving money for your retirement. There are different types of pension. One of the most common is a workplace pension. Benefits often are a function of pay and length of service. For example, a formula of 10% of compensation per year of service would provide an annual retirement. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. that these workers will receive in retirement—in other words, the DB pension must do the work of two legs of the three- legged retirement stool. Indeed. A payment or series of payments made to you after you retire from work. Generally, the amount of your income from a pension or retirement account. A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers. The returns generated from the investments serve as earnings to the employee upon retirement. How Do Pension Funds Work? Most commonly, pension plans are. A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the. Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of.

Defined benefit plan (pension plan that pays a retirement benefit spelled out in the plan) and you are eligible to participate for the plan year ending with or. The remaining fund generates a fixed, regular income for you during your retirement years. Types of Pension Plans. National Pension Schemes (NPS). The National. A pension scheme is a type of long-term savings plan. And it's a tax-efficient way to save during your working life. You save some of your income regularly. ERISA does not require employers to offer a pension plan, but sets minimum ERISA requires plan administrators -- the people who run plans -- to. At retirement, the employee will have an account that includes the accumulated value of contributions and investment returns minus any fees. The amount of money. Retirement plans or pension plans generally come with multiple benefits such as insurance cover and investment. These plans require you to pay a fixed amount. A defined benefit plan (e.g., a pension) is one where you know what to expect from your payout when you retire. A defined contribution plan (e.g. Pension benefits are typically a fixed monthly payment in retirement that is guaranteed for life. Some pension benefits grow with inflation. A pension scheme is a type of long-term savings plan. And it's a tax-efficient way to save during your working life. You save some of your income regularly. Congress set up PBGC to insure the defined-benefit pensions of working Americans. Defined-benefit pension plans are traditional pensions that pay a certain. A traditional pension plan offers retirees a fixed monthly benefit for the rest of their lives. How do they work? (k) plans. For a (k), an employee. How does a defined benefit pension plan work? Defined benefit pension plans pool the contributions from both you and your employer in a pension fund. Then, your. A (k) allows you some control over your fund contributions, while a pension plan does not. Pension plans guarantee a monthly check in retirement a (k). With a defined benefit pension scheme, you'll get a specified amount as income when you reach retirement age. Your pre-determined retirement income is based on. that these workers will receive in retirement—in other words, the DB pension must do the work of two legs of the three- legged retirement stool. Indeed. These public pension plans typically provide pensions based on members' years of service and average salary over a specified number of years of employment. Many. Retirement plans or pension plans generally come with multiple benefits such as insurance cover and investment. These plans require you to pay a fixed amount. Congress set up PBGC to insure the defined-benefit pensions of working Americans. Defined-benefit pension plans are traditional pensions that pay a certain. What do I get with this defined benefit account? · A customized funding proposal · High contributions that are generally % tax-deductible, within IRS limits · A. This means that employers are not required to provide a plan. However, once they set up a pension plan or a (k), (b) or other retirement savings plan.

1 2 3 4 5